In a move with sweeping fiscal and political implications, the current administration is reportedly targeting the tax-exempt status of municipal bonds, which have long been a cornerstone of public finance in the United States. The target is subtle but seismic. As Washington hunts for revenue in a high-deficit, post-pandemic economy, tax-exempt municipal bonds—long considered sacrosanct—are once again under scrutiny not only as a policy relic but also as a potential source of untapped federal dollars.

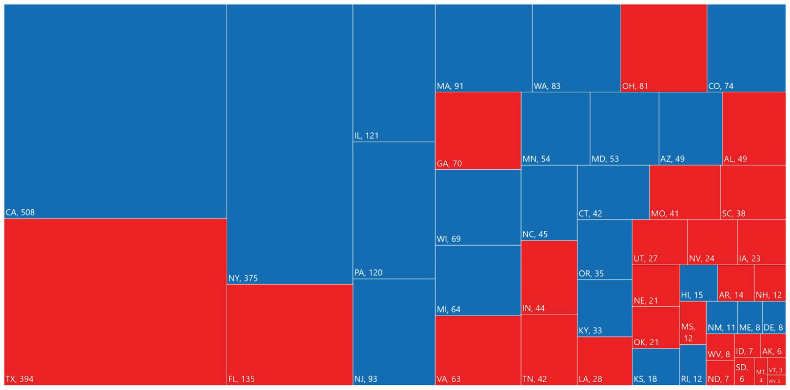

Yet beneath the arcane surface of bond markets and tax codes lies a policy lever that shapes daily life across the nation. From wastewater treatment in Ohio to hospital systems in Texas to public universities in Massachusetts, tax-exempt financing is the invisible architecture of modern public investment. It is also deeply bipartisan. Republican-led states account for $1.2 trillion in tax-exempt debt; Democratic strongholds carry $2.0 trillion. This is not just a question of tax reform—it is a test of political will, economic strategy, and federalism itself.

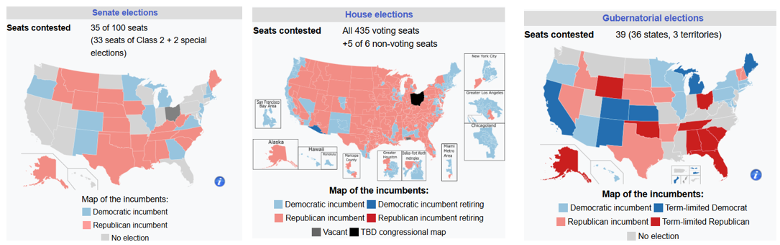

As Capitol Hill eyes potential repeal or curtailment, the risks grow clear: reduced infrastructure spending, increased borrowing costs for municipalities, and an increased cost passed down to voters and consumers alike. With the 2026 mid-term elections looming and 468 seats in Congress up for grabs, lawmakers face a dilemma—pursue short-term fiscal gains or preserve a century-old system that quietly underwrites the nation’s growth and fundamental infrastructure.

Note: Based on tax-exempt debt outstanding by the state as of 12/2/24 ($ = Billions)

Blue shading represents states led by Democratic governors; red shading represents states led by Republican governors.

Source: Bloomberg Finance L.P., Ballotpedia, J.P. Morgan

Understanding Tax-Exempt Municipal Bonds

Since their formal recognition in the federal tax code in 1913, tax-exempt municipal bonds have served as a foundational tool for public financing in the United States. These bonds, issued by state and local governments, attract investors by exempting the interest income from federal, state, and local taxes. That tax advantage translates into lower borrowing costs for municipalities, facilitating investments in critical infrastructure like utilities, hospitals, schools, and transit systems.

In 2024 alone, the municipal bond market saw nearly $500 billion in new issuance. Forecasts suggest that tax-exempt debt could finance an additional $3 trillion in infrastructure by 2031.1 Any change to this tax status would have ripple effects throughout the U.S. economy and directly into the country’s cities and towns.

The Repeal Debate: Scope and Consequences

While a sweeping, retroactive repeal of tax-exempt municipal bonds appears highly unlikely, the administration has signaled an openness to targeted reforms. These could include eliminating exemptions for specific sectors, modifying the eligibility criteria for bond issuers, or modifying tax-exemption by implementing a cap base to generate new federal revenues.

In the short term, such changes would likely reduce the appeal of municipal bonds, shrinking the investor pool and raising borrowing costs for issuers. The Government Finance Officers Association (GFOA) estimates that eliminating tax-exempt status could increase debt issuance costs by as much as 25%. This will have the most significant impact on smaller, rural municipalities, which have limited access to capital markets or alternative funding sources.

Moreover, the investor landscape would shift. Traditional buyers, such as high-net-worth individuals and insurance companies, could be replaced by foreign or institutional investors less attuned to local needs. Traditional tax-exempt issuers may consider more mergers, privatizations, or alternative financing options, which could involve increased regulatory risks or uncertain long-term viability.

Sectors Most Vulnerable

Although general-purpose infrastructure remains broadly supported, sectors with “corporate-like” characteristics face heightened scrutiny:

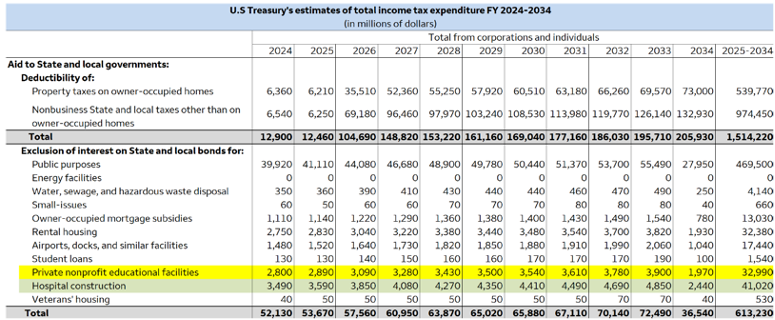

- Private Higher Education: Institutions with large endowments may face expansion of the 2017/18 Endowment Tax or limitations on access to tax-exempt financing.

- Hospitals: Large nonprofit health systems, particularly those with revenues over $1 billion, may face new tax regulations, such as property taxes.

- Private Activity Bonds: These bonds, often used for airports, industrial development, and sports stadiums, are viewed skeptically as indirect subsidies to private enterprise.

- Tobacco Settlements: Federal excise taxes could further reduce the value of these bonds, limiting state flexibility in using settlement revenues.

- Utilities: While not explicitly targeted, municipal utilities often operate like commercial enterprises and may be involved in broader reform efforts.

Lessons from the Past

Tax reform is never an isolated event. The last major overhaul—the Tax Reform Act of 1986—reshaped the landscape by lowering top income tax rates, restricting industrial development bonds, and eliminating key deductions for financial institutions. Municipal bonds issued for private purposes dropped from 20% of all issuances in 1985 to just 10% by 1993.

More recently, the 2017 Tax Cuts and Jobs Act prohibited tax-exempt advance refunding bonds, narrowing financing options for state and local governments. In each instance, federal policy shifts have altered the economics of municipal debt and the governance dynamics between Washington and Main Street.

Political Constraints and Election-Year Optics

With the 2026 election cycle on the horizon—including all 435 House seats and a third of the Senate—lawmakers will weigh tax reform proposals against potential political backlash. Few elected officials are eager to be seen as raising borrowing costs for schools or hospitals in an election year.

Source: Ballotpedia

It has been reported that eliminating tax exemptions could generate anywhere from $250 billion to over $600 billion in revenue over a decade; however, according to the Public Finance Network, this would effectively raise borrowing costs for municipal issuers by a cumulative $820 billion during that same period. In addition to financial cost, those savings come at a political price. Voters may view the move as a tax increase by another name, especially if higher municipal borrowing costs result in reduced services or increased local taxes.

That political calculus dampens the likelihood of sweeping reforms in the near term. Election-year optics matter, and municipal bonds enjoy powerful allies across both parties and all geographies.

Source: U.S. Treasury (09/08/24), Wells Fargo

Conclusion

The fight over municipal bond tax exemptions is not just a revenue skirmish; it is a referendum on the role of federal policy in enabling local autonomy. Repealing or narrowing these exemptions may promise short-term federal savings, but the long-term costs to municipalities, voters, and the national economy could be profound.

As elected officials navigate budget pressures and looming reelection campaigns, they should remember that tax-exempt municipal bonds are not loopholes. They are the scaffolding of public investment in the United States. To dismantle them without a clear, superior alternative is to risk undermining a century of bipartisan success in building bridges, hospitals, schools, and the trust binding local government to the people it serves.

The decision ahead is as much about vision as it is about policy. Should we tax capital at the expense of the community or preserve a proven system that turns local plans into national resilience?